indiana excise tax form

Federal tax forms such as. I am currently residing in the.

0 3 8307 Reply.

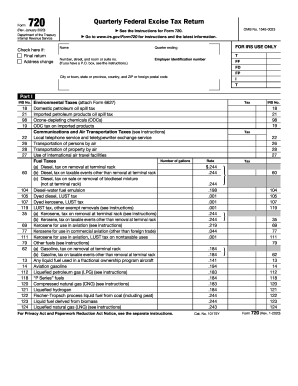

. INDIANA COUNTY VEHICLE EXCISE TAX AND WHEEL TAX for an example of how the tax is calculated. Excise Refund Claim Form. Form 720 is used to file many types of excise tax including the indoor tanning services excise tax.

The Indiana gas tax is included in the pump price at all gas stations in Indiana. Jobs Marketplace. The age of a vehicle is determined by subtracting the model year from the calendar year in which the vehicle is due to be registered.

My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee. APPLICATION FOR VEHICLE EXCISE TAX BUREAU OF MOTOR VEHICLES CREDIT REFUND Central Office Title Processing State Form 55296 R3 7-17 100 N. However if you would like to check to see if you are eligible for a refund or you would like to print out a claim form you can do that on this website.

Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. New Member June 4 2019 832 PM. Box 7089 Indianapolis IN 46207-7089 Nonprofit.

Publication 510 Excise Taxes PDF. National Guard Indiana. INDIANA AUDITOR OF STATE LOCAL GOVERNMENT DIVISION Types of Excise Taxes Assessment and Collection TreasurerAuditor Responsibilities.

Form 8864 Biodiesel and Renewable Diesel Fuels Credit PDF. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

In addition the tax does not affect collecting remitting or reporting Indianas 18-cents-per-gallon gasoline tax and 1-cent-per-gallon oil inspection fee. You should consult your tax professional to determine whether this will apply to you. Criminal Justice Institute.

This item is available to borrow from 1 library branch. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Indiana Career Connect.

Vehicle Excise Tax Flat Rate 12. APPLICATION FOR VEHICLE EXCISE TAX REFUND State Form 55677 R 10-14 Approved by State Board of Accounts 2014 INDIANA BUREAU OF MOTOR VEHICLES Bureau of Motor Vehicles Winchester Processing Center PO Box 100 Winchester IN 47394 888-692-6841 INSTRUCTIONS. Indiana Current Year Tax Forms.

Law Enforcement Academy Indiana. Excise Reconciliation Form SUMMARY TYPES OF EXCISE TAXES. The gasoline use tax does not affect form MF-360 and licensed gasoline distributors will need to continue to report gasoline.

BMV BMV Driven To Serve INDIANA BUREAU OF MOTOR VEHICLES. Find federal tax forms from the Internal Revenue Service online or call 1-800-829-3676. The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states.

INtax only remains available to file and pay the following tax obligations until July 8 2022. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A depending on your circumstances. Indianas excise tax on gasoline is ranked 19 out of the 50 states.

The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states. I am serving on active military duty in the armed forces of the United States. Find Indiana tax forms.

Motor Vehicle Excise Tax IC 6-6-5 Excise Tax Replacement. 140 Sign and date at the bottom of page 2. Complete in blue or black ink or print form.

Form 6627 Environmental Taxes PDF. 862018 2 During settlement time when you hear excise taxes this is referring to. Box 7206 Indianapolis IN 46207-7206 Form NP-20 PO.

Form 6478 Biofuel Producer Credit PDF. The excise tax amount is based on the vehicle class and age. Take the renters deduction.

What is excise tax on a car in Indiana. If the only excise tax you need to report is for indoor tanning services. Corrections Indiana Department of.

Form 8821 Tax Information Authorization PDF. You should consult your tax professional to determine whether this will apply to you. State Excise Police Indiana.

Recreational Vehicle Excise Tax. If the only excise tax you need to report is for indoor tanning services. Customers living in certain counties and municipalities will also pay a county and municipal.

Complete your information at the top of the form name address etc Enter the amount of tax paid on page 2 Part II IRS No. The exemptions provided in IC 6-25-5 apply to gasoline use. APPLICATION OF CREDIT Siqnature of Branch Manaqer.

Box 7228 Indianapolis IN 46207-7228 Correspondence PO. If you take the standard deduction on. Form 8849 Claim for Refund of Excise Taxes PDF.

Tips for Your Job Search. Ad signNow allows users to edit sign fill and share all type of documents online. Homeland Security Department of.

Find forms online at our Indiana tax forms website order by phone at 317-615-2581 leave your order on voice mail available 24 hours a day. Number January 12012 12345 Hamilton ISSUED TO. File and pay Form.

Motor Vehicle Rental Excise Tax. United States Internal Revenue Service. Passenger vehicles and recreational vehicles have separate vehicle excise tax rates.

TO THE BUREAU OF MOTOR VEHICLES OF THE STATE OF INDIANA. Know when I will receive my tax refund. Senate Avenue Room N417 Indianapolis IN 46204 INDIANA BUREAU OF MOTOR VEHICLES 888 692-6841.

APPLICATION FOR VEHICLE EXCISE TAX CREDIT REFUND. Visit the Forms and Pubs page. What else can I deduct if I take the standard deduction.

On our secure site please enter your name and either your drivers license number or your social security number. Create Legally Binding Electronic Signatures on Any Device. Form 6478 Biofuel Producer Credit PDF.

Qualified Veteran Excise Tax Credit State Form 52870. Vehicle Sharing Excise VSE-103 Motor Fuel MF-360 Gasoline Use GT-103. View solution in original post.

Publication 3536 Motor Fuel Excise Tax EDI Guide PDF. AFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAX State Form 46402 R4 2-13 INDIANA BUREAU OF MOTOR VEHICLES SECTION 1 - APPLICANT AFFIRMATION To receive a military exemption from excise tax all of the following criteria must be met. To check if your business is eligible for a.

Whether registering your vehicle for the first time or renewing your registration you will pay an annual excise tax and a registration fee. The item Form 8849 claim for refund of excise taxes represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

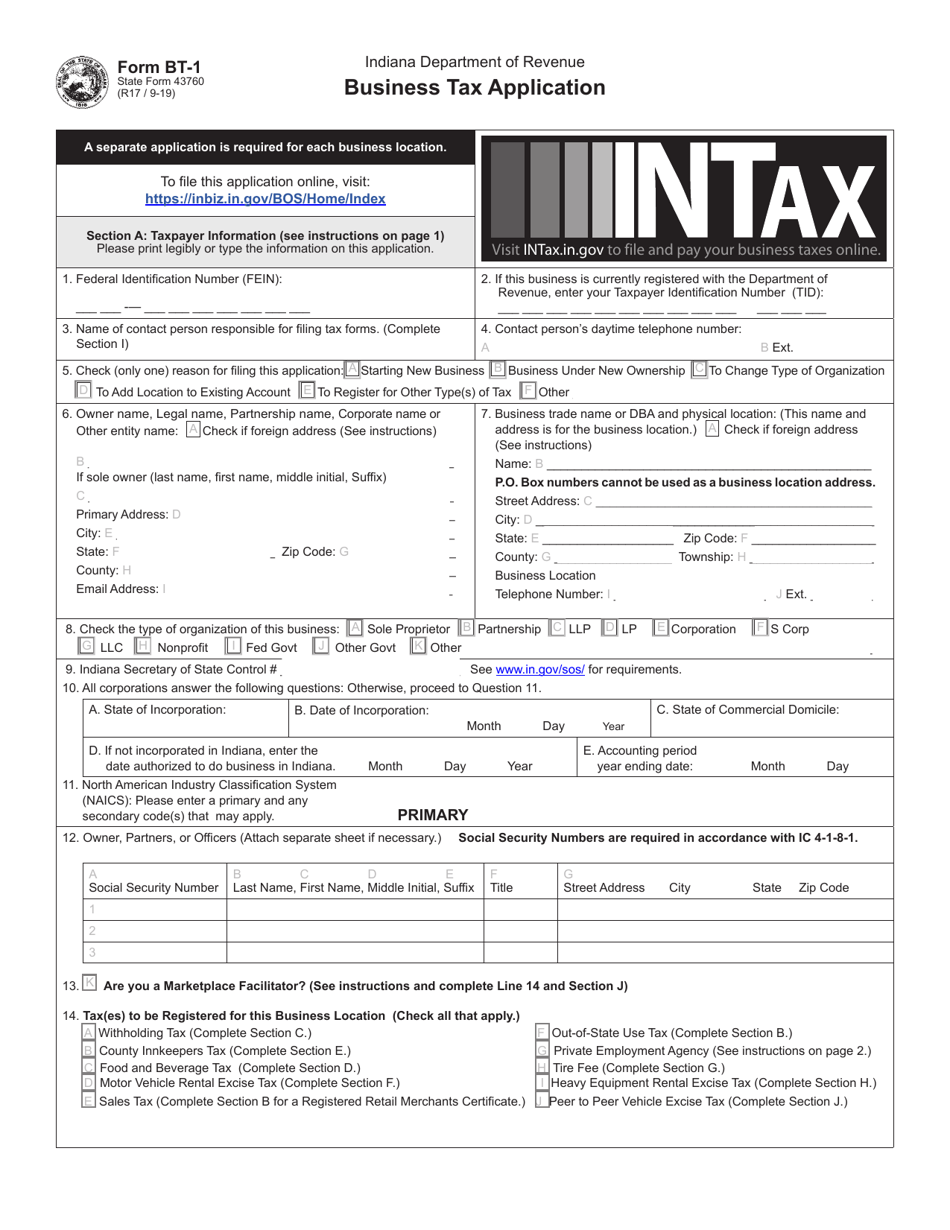

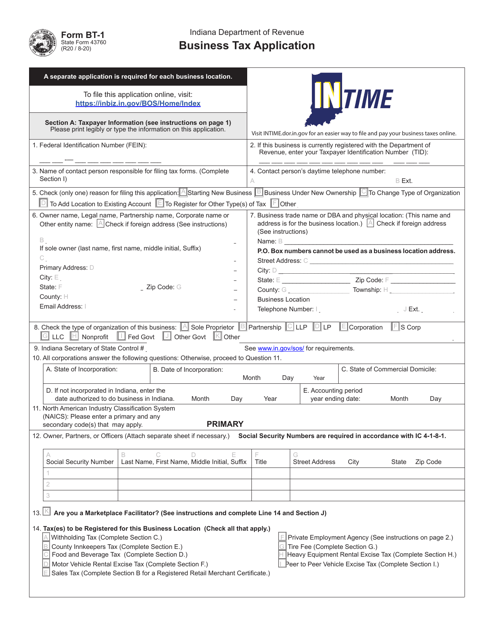

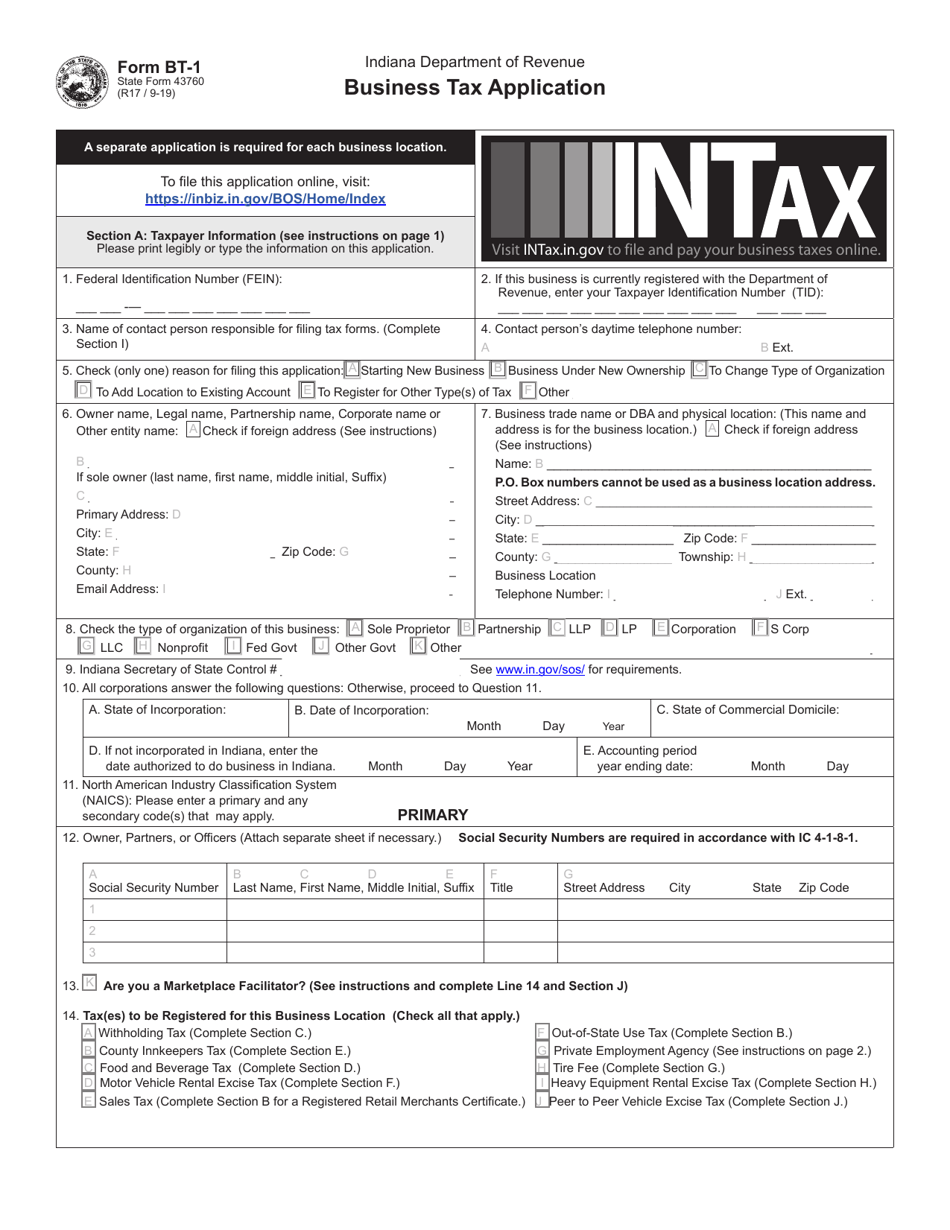

Form Bt 1 State Form 43760 Download Fillable Pdf Or Fill Online Business Tax Application Indiana Templateroller

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

State Form 43760 Bt 1 Download Fillable Pdf Or Fill Online Business Tax Application Indiana Templateroller

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220

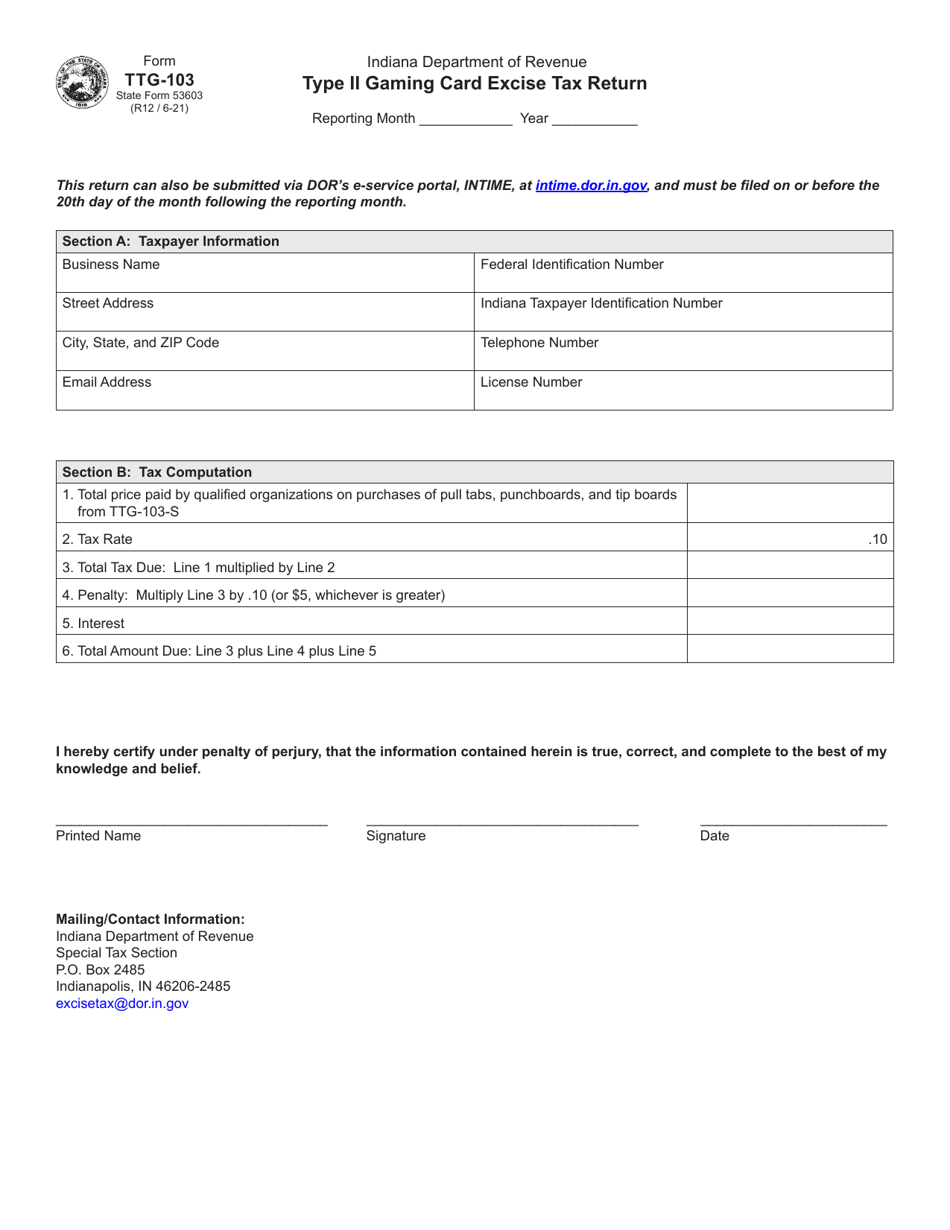

Form Ttg 103 State Form 53603 Download Fillable Pdf Or Fill Online Type Ii Gaming Card Excise Tax Return Indiana Templateroller

Indiana Tax Application Fill Online Printable Fillable Blank Pdffiller

Release Of Interest In Indiana License Plate And Excise Tax Forms In Fill And Sign Printable Template Online Us Legal Forms

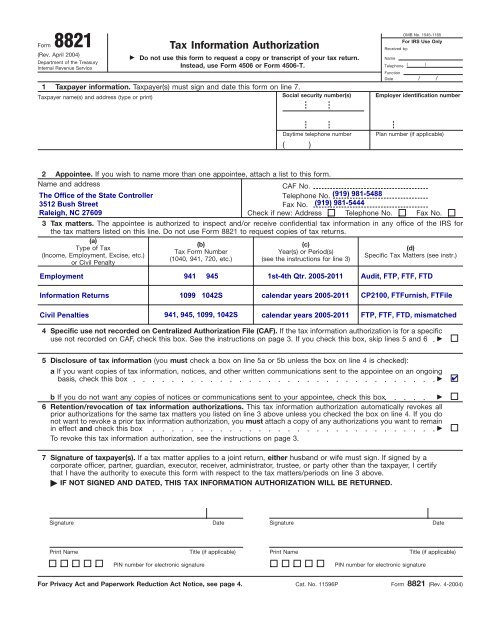

Irs Form 8821 Tax Information Authorization North Carolina Office

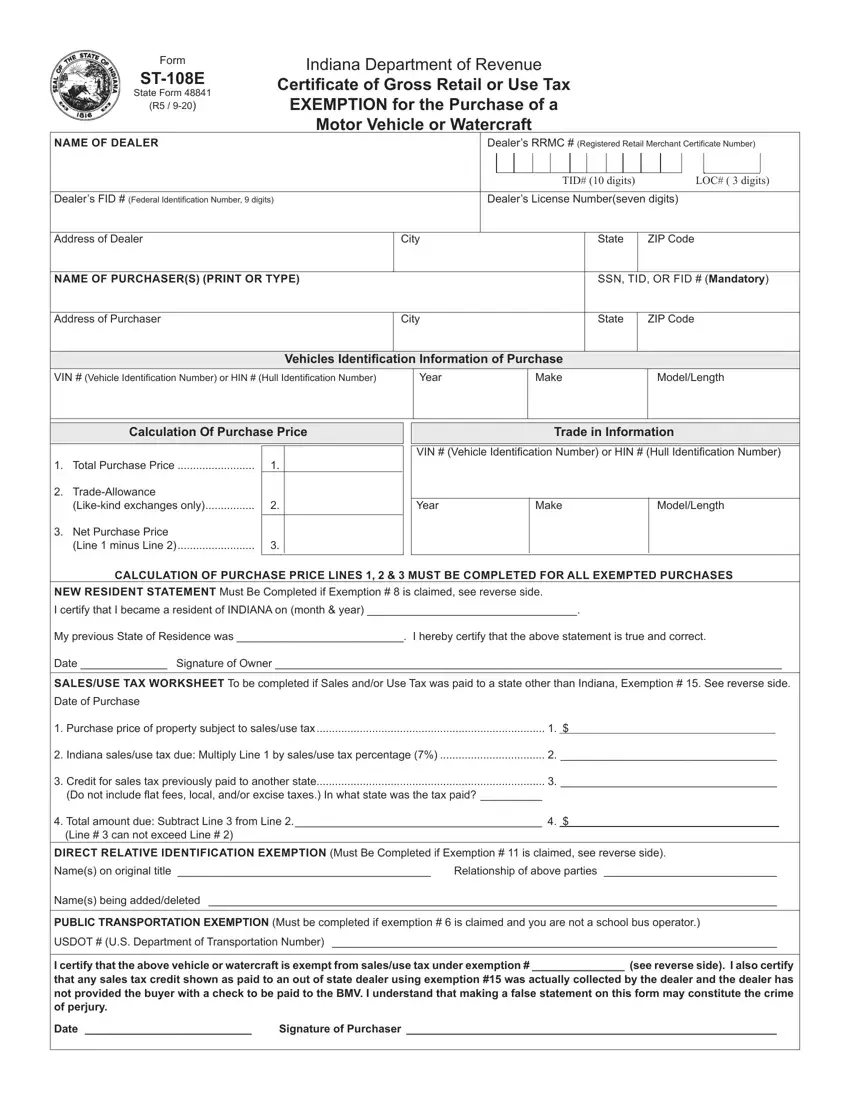

St 108e State Form Fill Out Printable Pdf Forms Online

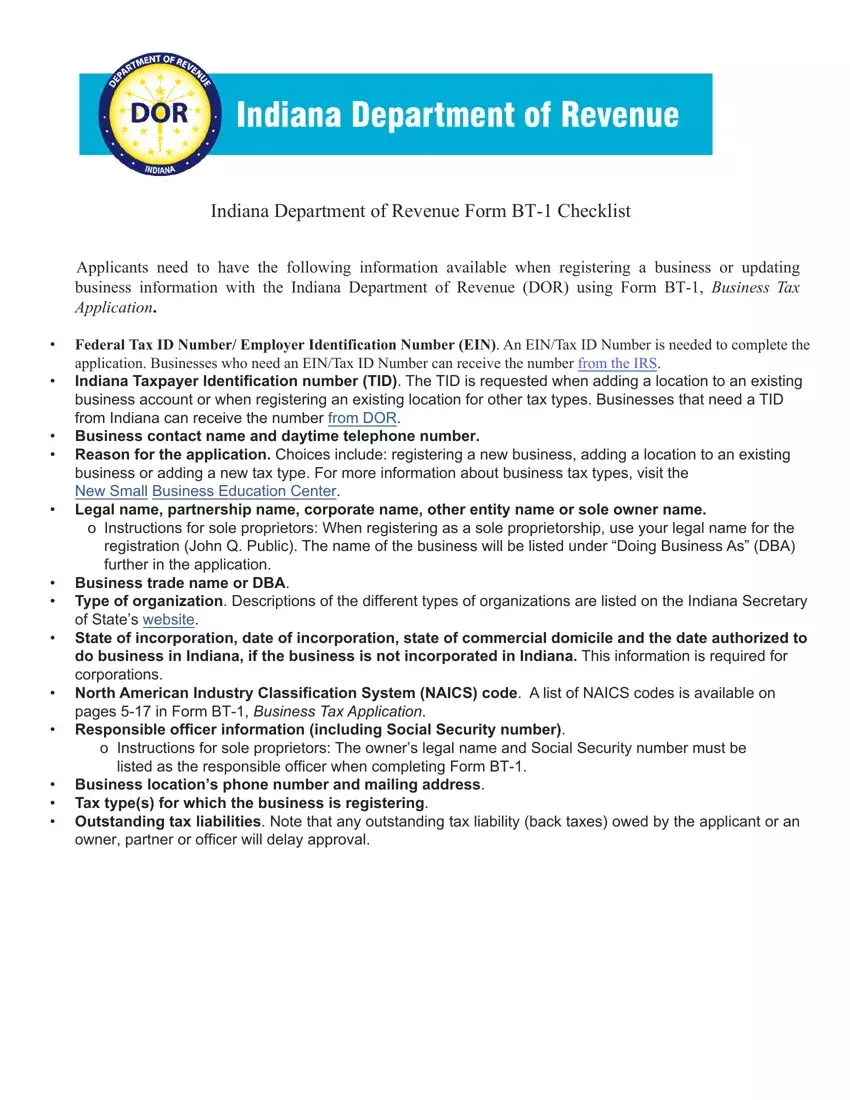

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Irs Form 720 Fill Out And Sign Printable Pdf Template Signnow

3 11 3 Individual Income Tax Returns Internal Revenue Service