fha gift funds from fiance

The minimum amount you can receive as a gift is 500 and there is no maximum. FHA Mortgages allow borrowers to use Gift Funds to meet the 35 down payment requirement.

FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned.

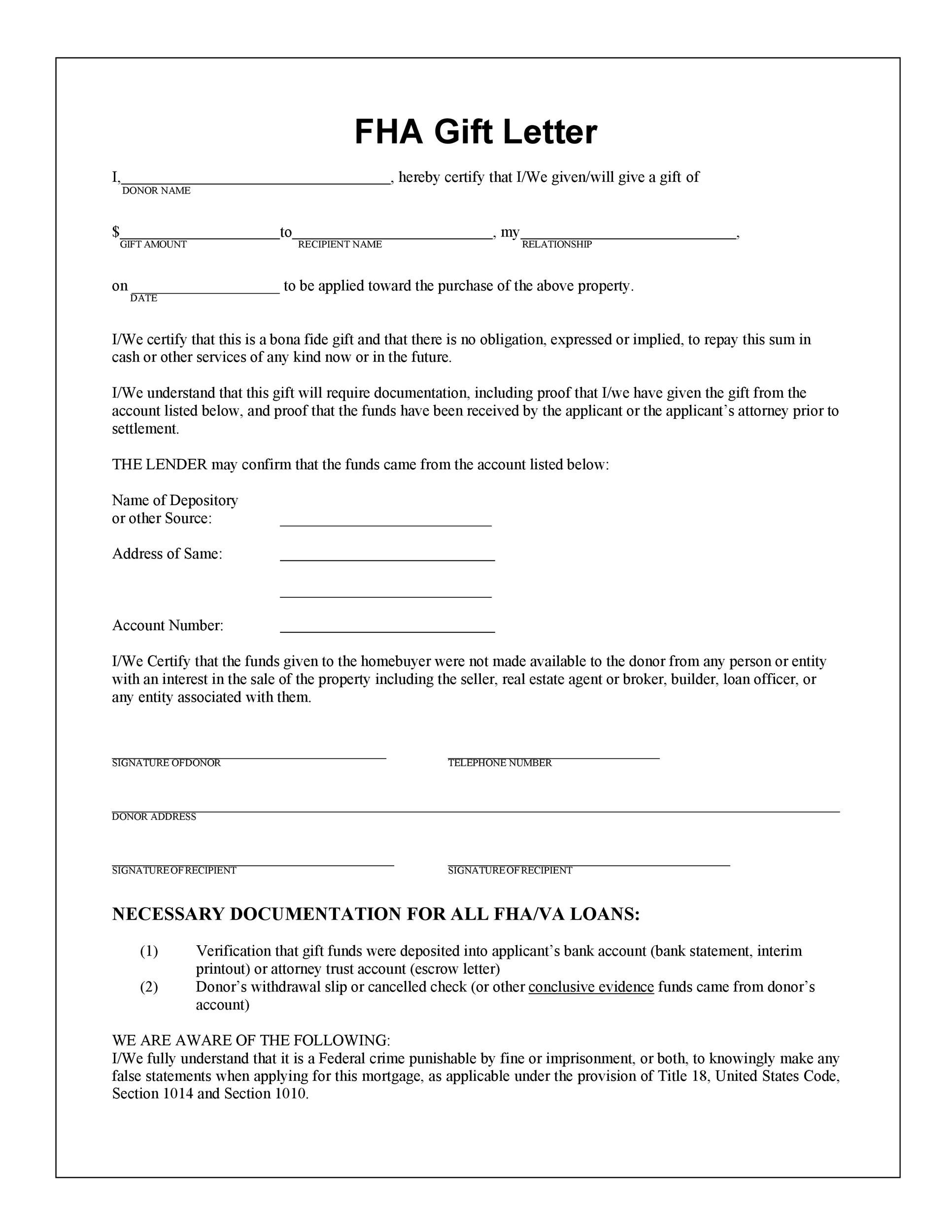

. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. Fannie Mae also allows gifts from future in-laws. However the FHA program allows you to obtain the downpayment through a gift.

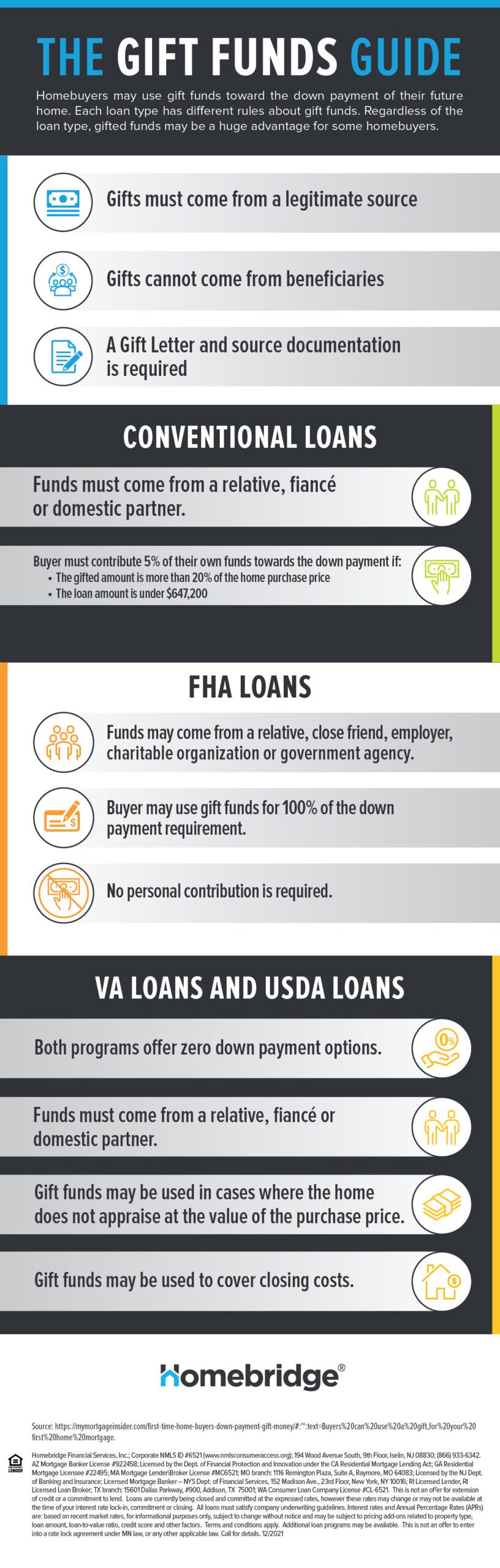

Using gift money with an FHA loan. Gift funds are an acceptable source of down payment and or funds for closing costs with an FHA mortgage. The Federal Housing Administration offers the FHA loan for borrowers with low-to-moderate income levels.

Fha gift funds guidelines state that 100. Here are some guidelines when using a gift fund for FHA. GCA Mortgage Mortgage Experts With No Overlays.

This is much lower than a. FHA loans do not. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

The portion of the gift not used to. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. Gift funds may only be provided by a borrowers family member.

If the gift and giver meet certain FHA requirements gift funds can be used as a down payment. Gift funds are commonly used for home loan expenses including. All of your down.

The FHA Gift Fund can be used for both the down payment and closing costs on your home. FHA Gift Funds Guidelines allows 100 gift funds from family members andor relatives to be used as a down payment towards a home purchase. If you apply for an FHA loan your gift funds.

Most home buyers who use FHA come up with at least 35 percent down from their own funds. When using Gift Funds to purchase a home it is important that Gift Funds be. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

FHA loans requires that borrowers who receive a Gift of Equity must have a minimum down payment of 35 percent of the homes final purchase price.

Down Payment Gift Home Loan Mortgage Low Rates Low Fees 1st Choice Mortgage Boise Meridian Nampa Caldwell

/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

How To Document Mortgage Down Payment Gifts

Using Gift Funds To Buy A Home Homebridge Financial Services

Down Payment Gifts Use What Your Mama Or Another Family Member Gave Ya Quicken Loans

How To Use A Gift Letter For A Home Down Payment

35 Best Gift Letter Templates Word Pdf ᐅ Templatelab

Using Gift Funds To Buy A Home Homebridge Financial Services

Documenting Gift Funds To Close On Your First Home

How To Use Gift Money For A Down Payment On A Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter

Documenting Gift Funds To Close On Your First Home

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds How Can I Use Them To Buy A Home

Gift Letter For A Mortgage What To Know And How To Use One

Mortgage Down Payment Gift Rules Financing Fundamentals

What To Know Before Using Gift Funds For Down Payment Mybanktracker

A Gift Fund Or Gift Of Equity Can Be Your Best Gift Ever Prmi Delaware