maine tax rates for retirees

Your 2022 Tax Bracket To See Whats Been Adjusted. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and.

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

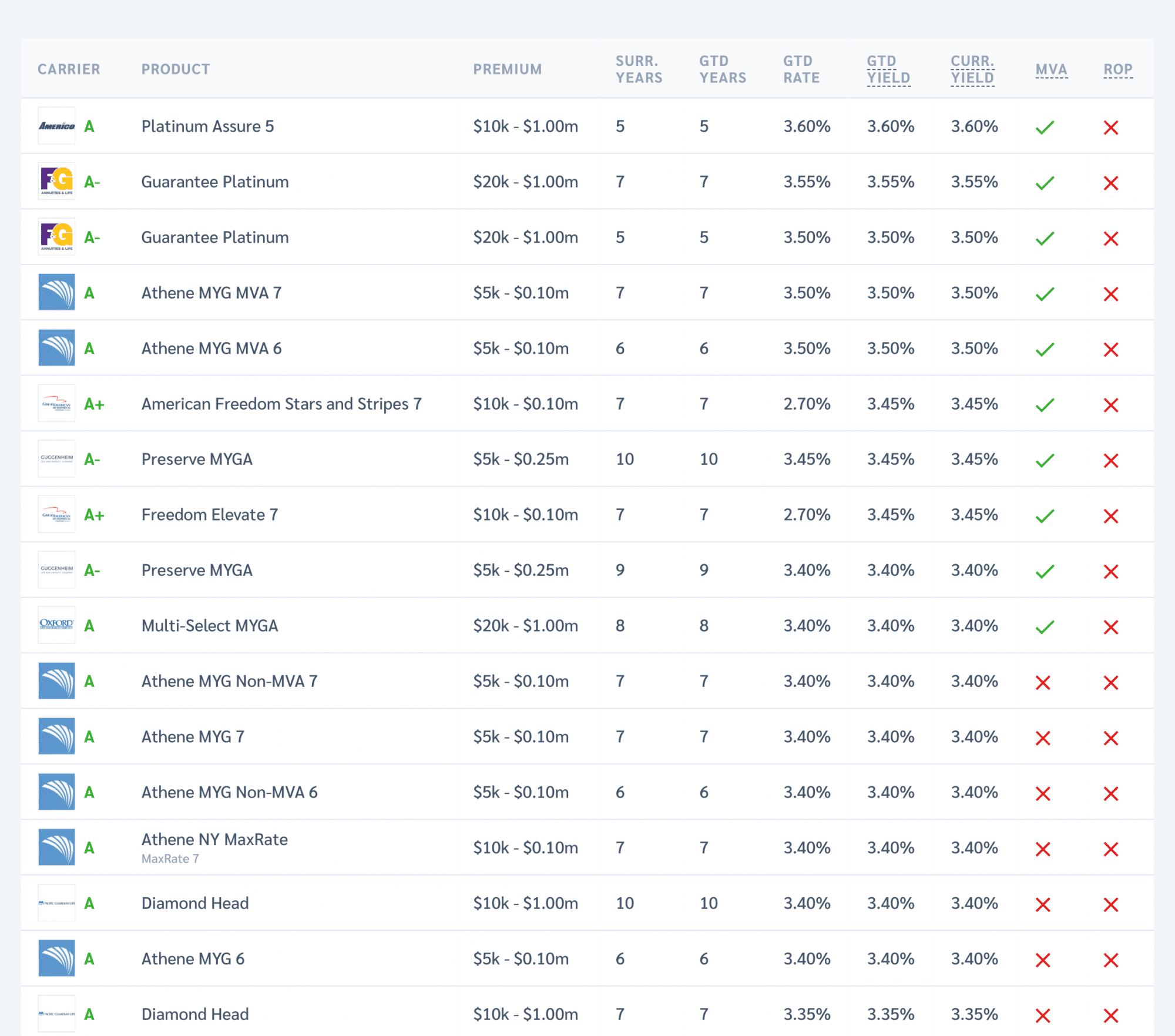

11 hours agoOverall the average compound annualized growth rate of the 6040 portfolio.

. Maine offers low tax rates on specific items. Established a 39 flat income tax rate and eliminated state tax on retirement income in. Ad This guide may help you avoid regret from making certain financial decisions.

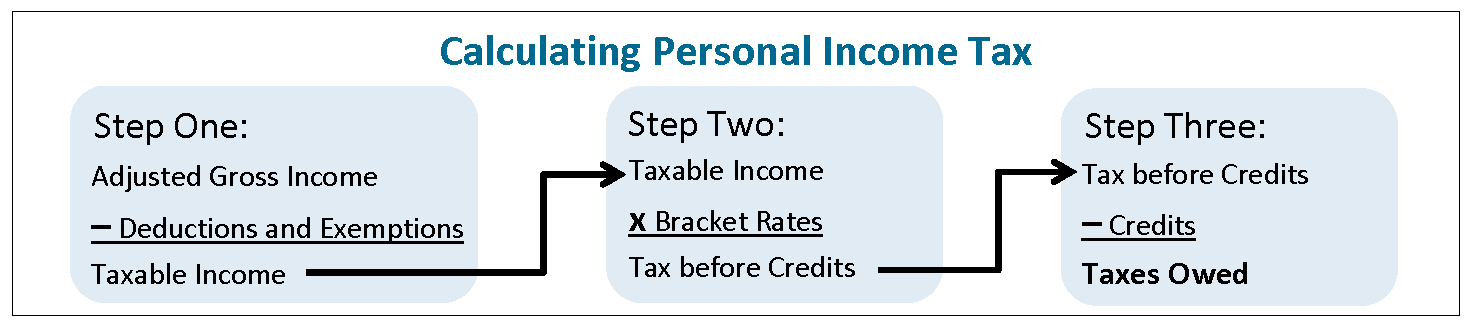

The 2022 CPI-U is 91. Maines income tax rate ranges from 58 to a top marginal rate of 715. For more information please see this document and then contact your tax advisor or Maine.

You can find this or follow it throughout the year on the Bureau of. Avoid investment mistakes in your retirement savings accounts many others make. Maine has a graduated individual income tax with rates ranging from 580 percent to 715.

Maines tax brackets are indexed for inflation and are updated yearly to reflect changes in cost. The income tax rates are graduated with rates ranging from 58 to 715 for tax years. Retiree has not paid.

Retiree paid Federal taxes on contributions made before January 1 1989. Its gasoline tax is 3001 cents per. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

Although the state does not tax Social Security income expect high tax rates of up to 715 on. Ad Compare Your 2023 Tax Bracket vs.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

States With The Highest Lowest Tax Rates

States That Won T Tax Your Federal Retirement Income Government Executive

Concerned Taxpayers Of Scarborough Maine The Town Of Scarborough Has Now Provided Preliminary Information On The New Tax Rate Or Mil Rate For Next Year And As Most Of You Already

![]()

Report Millionaires Didn T Flee When Tax Rates Increased In Certain States Maine Beacon

Pros And Cons Of Retiring In Maine Cumberland Crossing

How Maine S Personal Income Taxes Work Mecep

Map How High Is Your Town S Property Tax Rate Press Herald

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

15 States That Don T Tax Retirement Income Pensions Social Security

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Maine Property Tax Rates By Town The Master List

Maine Property Tax Rates By Town The Master List

State Withholding Tax Table Maintenance Maine W Hx02

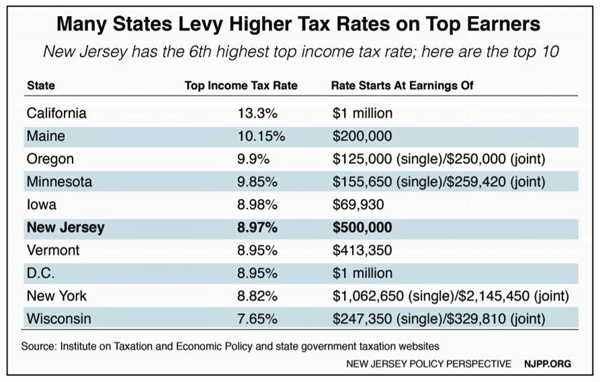

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

States That Don T Tax Social Security

Maine Retirement Taxes And Economic Factors To Consider

These States Don T Tax Military Retirement Pay

Tax Withholding For Pensions And Social Security Sensible Money